ABOUT USSustainability

Sustainability Approach

Sustainability Commitment

In 2020, CapitaLand unveiled its 2030 SMP to elevate its commitment towards global sustainability in the built environment. The Master Plan focuses on three key pillars to drive CapitaLand's sustainability efforts in the ESG pillars, enabling CapitaLand to create a larger positive impact for the environment and society:

- Build portfolio resilience and resource efficiency,

- Enable thriving and future-adaptive communities, as well as

- Accelerate sustainability innovation and collaboration

As a CLI-listed REIT, CLCT aligns its sustainability objectives and strategies with CapitaLand Group. It is committed to improving the economic and social well-being of its stakeholders through management of human capital, asset, portfolio operations and project development. The Manager works closely with the Asset & Property Managers in carrying out these strategies and relevant activities across its portfolio where possible.

CapitaLand has identified five pathways to achieve its sustainability objectives. CLCT is aligned with these objectives and will continually adapt its strategies as technologies evolve and new scientific data become available:

CLCT is aligned with CapitaLand's 2030 SMP to elevate the Group's commitment to global sustainability in the built environment. The SMP drives CapitaLand's sustainability efforts in the ESG pillars, enabling the Group to create a larger positive impact for the environment and society.

CapitaLand's 2030 SMP is regularly reviewed where necessary to complement the Group's business strategy and align with climate science. The first scheduled review in 2022 is in progress and the outcome will be published before end May 2023.

CLCT is also aligned with CapitaLand's science-based targets set out in CapitaLand's 2030 SMP as we transit to a low-carbon business. CapitaLand's carbon emissions intensity reduction target is computed from the approved science-based target, to better track day-to-day operational efficiency. As part of the CapitaLand Group, CLCT is committed to working towards the long term and annual targets under CapitaLand's 2030 SMP Framework3. CapitaLand's long-term targets are as follows:

- Reduce carbon emissions intensity by 78% by 2030

- Reduce energy consumption intensity by 35% by 2030

- Reduce water consumption intensity by 45% by 2030

(Using 2008 as base year)

-

Board Statement

-

Board, Top Management and Staff Commitment and Involvement

-

Strategic Sustainability Management Structure

-

Prioritisation of ESG Material Issues

-

Stakeholder Engagement

Board Statement

At CapitaLand China Trust, sustainability is at the core of everything we do. We are committed to growing in a responsible manner, delivering long-term economic value, and contributing to the environmental and social well-being of our communities. The material environmental, social and governance (ESG) factors have been identified and encapsulated in the CapitaLand 2030 SMP, which was launched in 2020, and will be reviewed by the CapitaLand Investment Board of Directors together with Management every two years.

The CapitaLand 2030 SMP steers our efforts on a common course to maximise impact through building a resilient and resource-efficient real estate portfolio, enabling thriving and futureadaptive communities, and accelerating sustainability innovation and collaboration. Ambitious ESG targets have been set which include carbon emissions reduction targets validated by the Science Based Targets initiative (SBTi). During the first scheduled review in 2022, CapitaLand Investment revised its SMP targets to elevate its SBTi-approved targets in line with a 1.5˚C scenario, incorporate its Net Zero commitment, and enhance its focus on social indicators.

The CLCT Board is responsible for overseeing the REIT's sustainability efforts and takes ESG factors into consideration in determining its strategic direction and priorities. The CLCT Board also approves the executive compensation framework based on the principle of linking pay to performance. CLCT's business plans are translated to both quantitative and qualitative performance targets, including sustainable corporate practices, and are cascaded throughout the REIT.

Board, Top Management and Staff Commitment and Involvement

The CLCT Board is responsible for overseeing the REIT's sustainability efforts and takes ESG factors into consideration in determining its strategic direction and priorities. The CLCT Board also approves the executive compensation framework based on the principle of linking pay to performance. CLCT's business plans are translated to both quantitative and qualitative performance targets, including sustainable corporate practices, and are cascaded throughout the REIT.

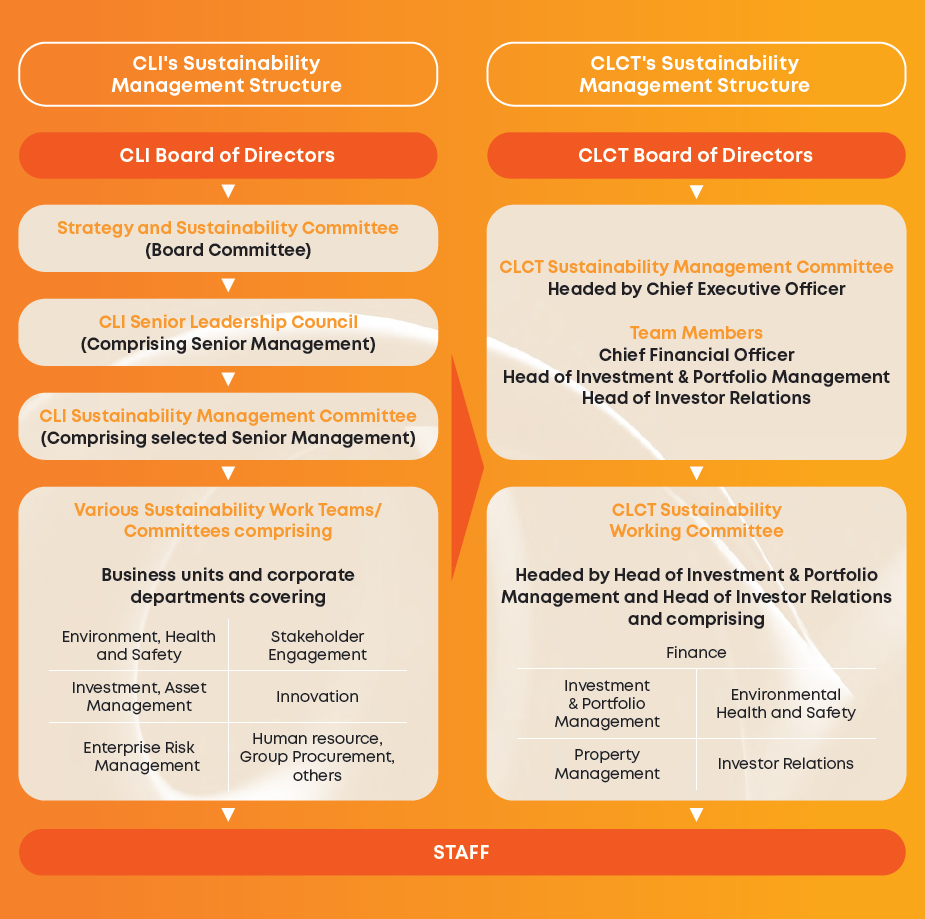

On a regular basis, the CLI Board is updated through the Strategy and Sustainability Committee (SSC)6 on the sustainability management performance of the Group, key material issues identified by stakeholders, and the planned follow-up measures. Additionally, through the Risk Committee and Audit Committee, the CLI Board is typically updated at least once a year and at ad hoc Board meetings on matters relating to sustainability risks, and relevant performance metrics, including carbon emissions performance, progress on achieving the reduction targets, green certification, human capital development, as well as stakeholders' expectations on climate change and/ or other social matters. They are also informed of any work-related safety incidents, business malpractice incidents and environmental incidents, which may include climate-related damages or disruptions.

The SSC, a Board Committee chaired by the Lead Independent Director, is responsible for overseeing CLI's sustainability strategies and goals, including providing guidance to Management and monitoring progress against achieving the goals of sustainability initiatives. The SSC typically meets twice a year, with additional meetings convened as necessary.

The sustainability work teams comprise representatives from CLI business units and corporate functions. Each business unit also has its own Environmental, Health and Safety (EHS) Committee to drive initiatives in countries where it operates with support from various departments.

At CLCT, a Sustainability Management Committee (SMC) was established to ensure greater focus on sustainability and climate-related matters of CLCT's assets. The SMC is chaired by CLCT's CEO and comprises senior management team members to oversee CLCT's sustainability objectives and strategies directly. The SMC is responsible for providing timely and regular updates on the REIT's sustainability matters to CLCT's Board of Directors and its Chairman. Regular updates to the CLCT Board of Directors include value and mission statements, goals, strategies overviews, policies and progress related to sustainable development.

The SMC is supported by CLCT's Sustainability Working Committee (SWC), which comprises key members from various business functions, to implement sustainability-related activities and initiatives across CLCT's operations as per CLI's sustainability framework and policies.

CLCT's sustainability governance is inter-linked with the Sponsor's sustainability management. The overall governance comes under the purview of the CLI Senior Leadership Council. CLCT is represented at the CLI Senior Leadership Council by CLCT's CEO who provides guidance on sustainability strategies and goals for CLCT.

This report's content, including the material topics, are reviewed and approved by the CLCT's Board of Directors. During board meetings, sustainability policies and strategies are discussed and reviewed as well.

Strategic Sustainability Management Structure

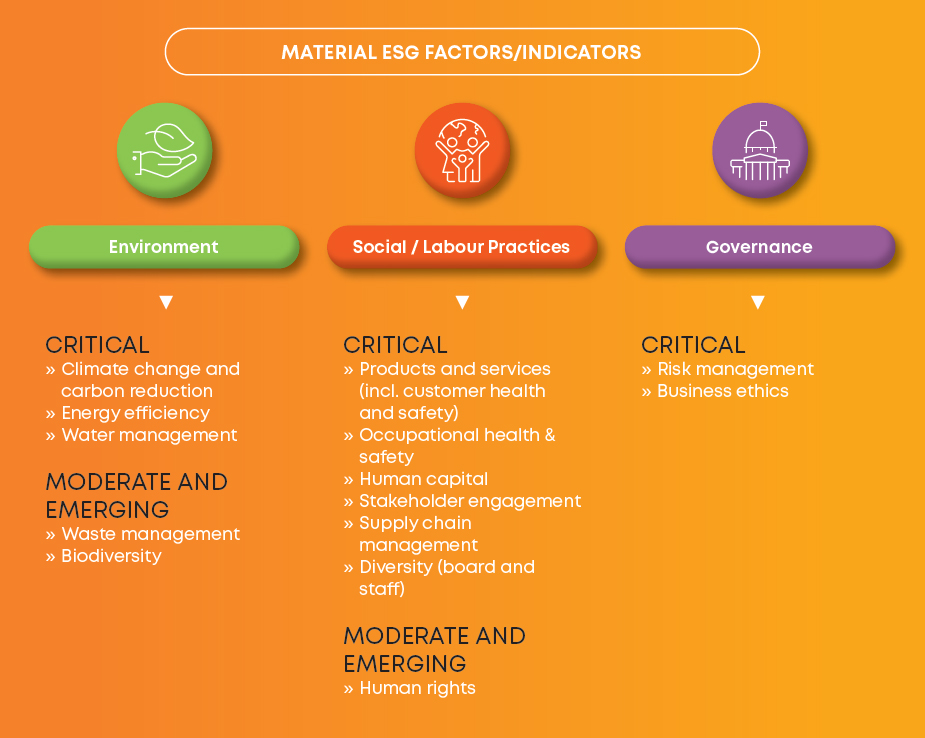

CLCT is guided by CLI's materiality assessment process, which includes regular reviews, assessments and feedback in relation to ESG topics. Key to this is an annual Group-wide Risk and Control Self- Assessment exercise which entails the identification, assessment and documentation of material risks and corresponding internal controls. These material risks include fraud and corruption, environmental (e.g. climate change), health and safety, and human capital risks which are ESG-relevant.

Guided by CapitaLand's 2030 SMP to elevate the Group's commitment to global sustainability, CLCT, as a CLI-listed REIT, identifies and reviews material issues that are most relevant and significant to the Company and its stakeholders. These ESG material issues are assessed and prioritised based on the likelihood and potential impact of issues affecting the business continuity of CLCT. For external stakeholders, priority is given to issues important to the community and applicable to CLCT.

Prioritisation of ESG Material Issues

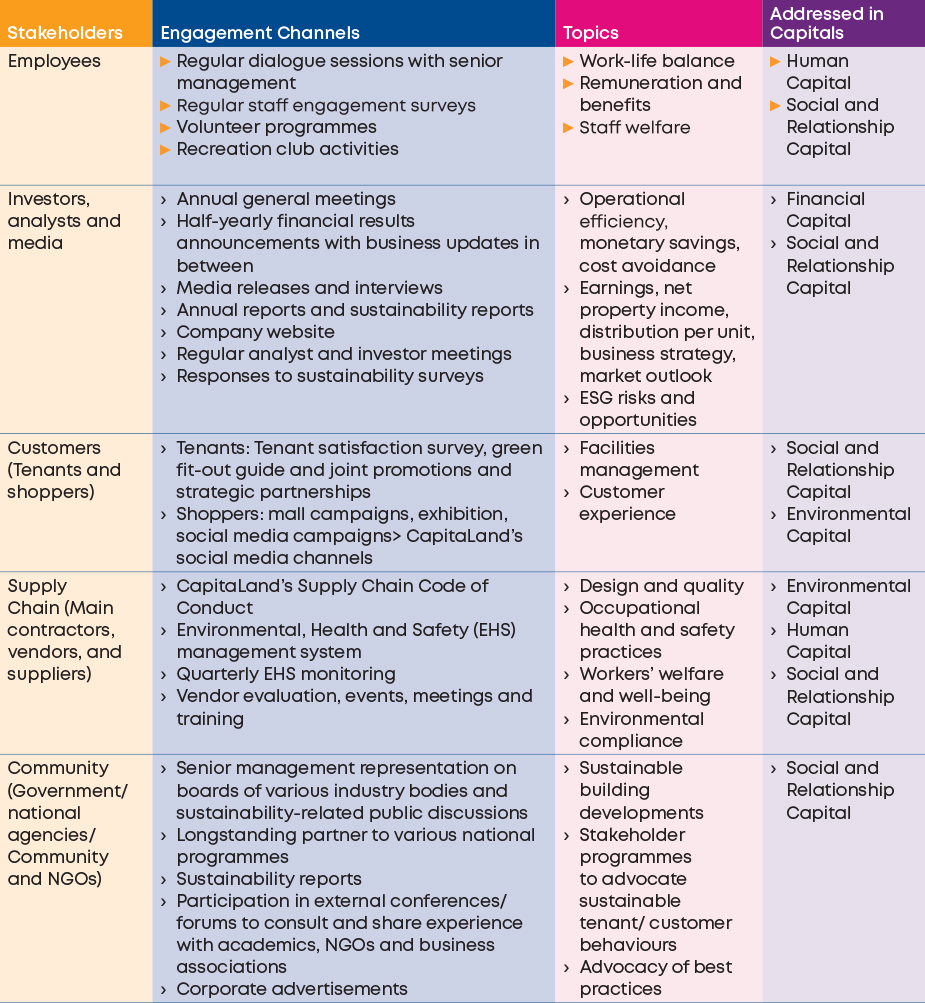

Stakeholder Engagement

CLCT proactively engages its stakeholders to better address their needs, build social and relationship capital, and create shared values for the long term. CLCT identifies its stakeholders as individuals, organisations, and communities that are directly or indirectly impacted by its operations. Its stakeholders include employees, investors, tenants, shoppers, contractors, vendors, governments and NGOs. Through the various engagement channels, CLCT seeks to understand its stakeholders' views, to effectively communicate with them and respond to their concerns.

For more details on how we engaged our stakeholders in 2022, please refer to pages 41 to 43 of this Integrated Sustainability Report.

Strategy & Key Objectives

-

Creating Value and Alignment to United Nations Sustainable Development Goals (UN SDGS)

-

Value Creation Strategy

Creating Value and Alignment to United Nations Sustainable Development Goals (UN SDGS)

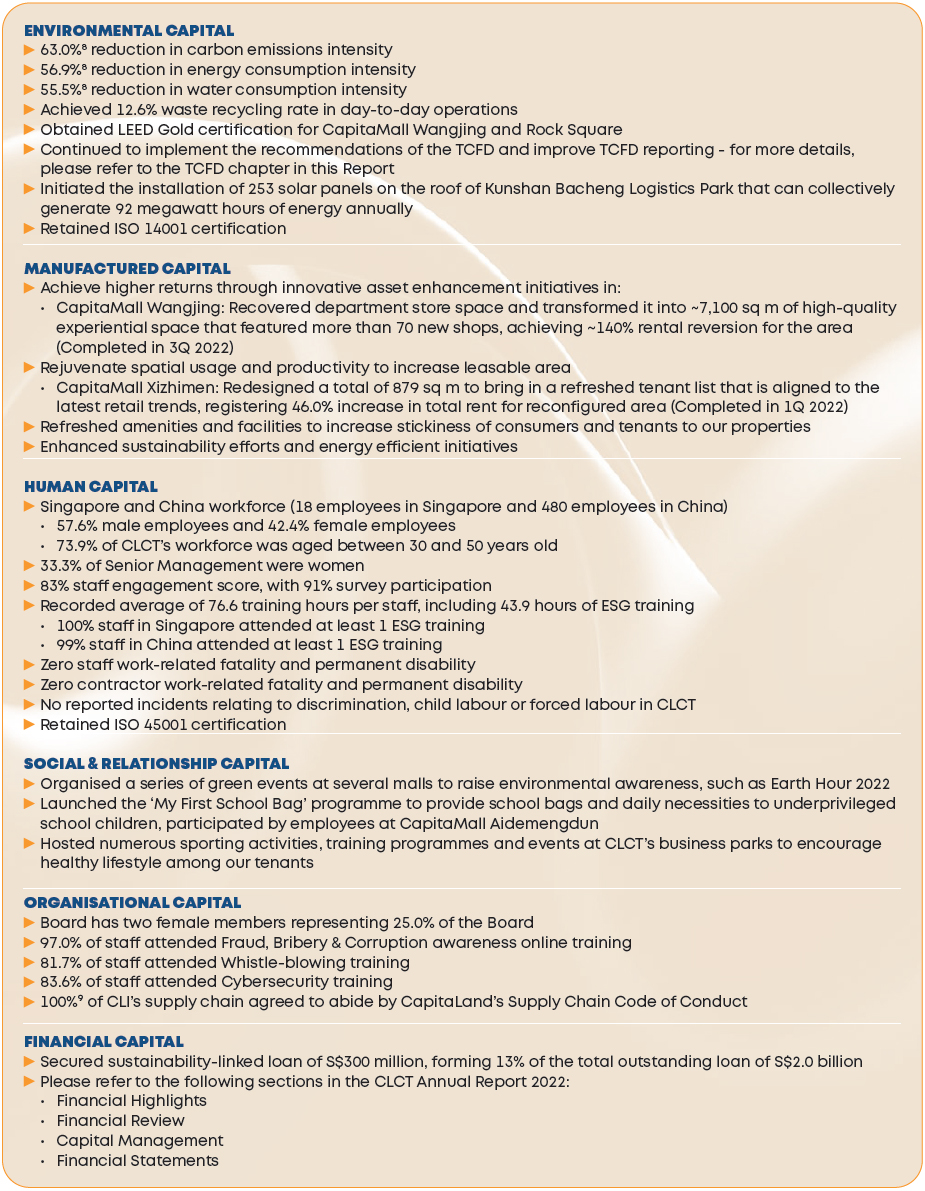

As a CLI-listed REIT, CLCT’s material ESG issues and the value created, aligned to CapitaLand’s 2030 SMP focus areas and commitments7, are mapped to six integrated reporting Capitals – Environmental, Manufactured, Human, Social and Relationship, Organisational, and Financial. This is further mapped against eight UN SDGs that are most aligned with CapitaLand’s 2030 SMP focus areas, and where CLI can achieve the greatest positive impact.

The UN SDGs call on companies everywhere to advance sustainable development through the investments they make, the solutions they develop, and the business practices they adopt. In doing so, the goals encourage companies to reduce their negative impacts while enhancing their positive contributions to the sustainable development agenda.

For more details of the value creation strategy, please refer to pages 26 to 29 of CLCT’s Annual Report 2022.

Value Creation Strategy